Claim Your ERC Tax Credit

Congress enacted it to help small and medium-sized businesses that suffered economic harm related to the Covid pandemic during 2020 and/or 2021. Unlike much of the earlier federal Covid relief, the ERC is not a loan. It's a tax refund payable in cash and completely legitimate.

PPP

You can still take ERC if you took a PPP loan

$325k+

Average claim with 50 employees or less

$26k

Max amount you can claim per qualified employee

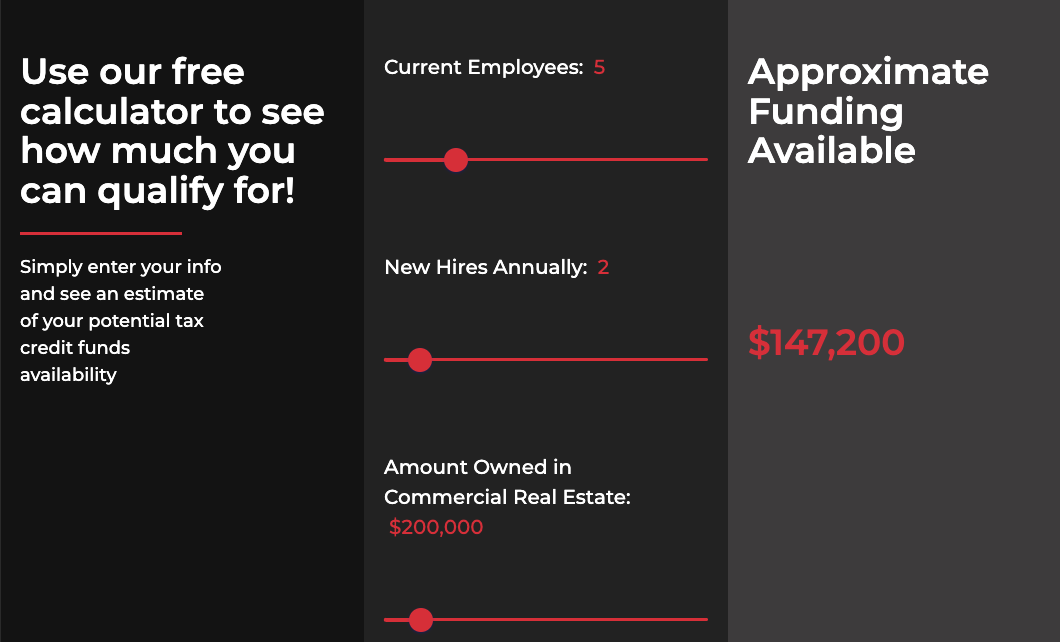

What's Available to Your Business?

What is ERC?

The Employee Retention Tax Credit was created to support businesses needing relief from the pandemic and those who had enrolled employees on payroll. Eligible employers can earn up to $26,000 per employee.

ERC Real or a Scam?

Deadlines to Retroactively Claim ERC Extended to 2024 / 2025

Although the Employee Retention Tax Credit (ERC) program has sunset officially, this does not impact the ability of a business to claim ERC retroactively. In fact, businesses can conduct a look-back to determine if wages paid after March 12, 2020, through the end of the program are eligible.

The time Is Now

Time is of the essence. The max refund will be reduced every quarter until the program shuts down, so waiting to apply means you’ll end up with a smaller refund.

Unlock Your Business's Financial Potential

Take the first step by scheduling a complimentary guided assessment with Snapshot Business Services. Our experts are ready to provide valuable insights and tailored recommendations to drive your business forward.